Reported by Lora Jones BBC News

Price falls for some food items like meat, crumpets and chocolate biscuits helped drive inflation down to its lowest level in two-and-a-half years.

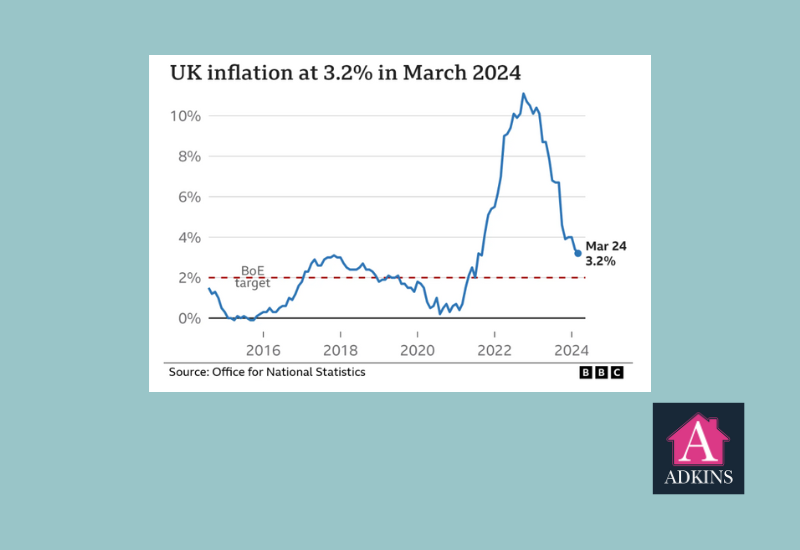

The rate consumer prices have been rising at fell to 3.2% in the year to March, down from 3.4% the month before, according to official figures.

Inflation has been falling gradually since it peaked at 11.1% in late 2022.

However, lower inflation does not mean prices overall are coming down, they are just rising less quickly.

According to the Office for National Statistics (ONS), the price rises seen across most types of food products eased between February and March, with small increases being seen for bread and cereals.

But meat prices fell by 0.5% between February and March, compared with a rise of 1.4% a year ago, with pork products one of the big reasons behind the slowing rate.

Soaring food and energy bills have been the main causes behind the UK's high inflation in recent years.

Oil and gas were in greater demand after the Covid pandemic, and prices surged again when Russia invaded Ukraine, cutting global supplies. The conflict also reduced the amount of grain for sale, pushing up food prices.

It led to inflation for food and non-alcoholic drinks hitting a peak of 19.2% in March last year - the highest level seen since the 1970s.

Elsewhere, the latest official figures showed the prices of furniture and household goods like cleaning products fell by 0.9% in the year to March.

But Grant Fitzner, chief economist for the ONS, said lower costs were off-set by rising fuel prices last month.

While the overall rate of inflation in March was slightly higher than economists expected, Chancellor Jeremy Hunt described the figures as "welcome news".

He said that due to lower inflation and the government's recent cut in National Insurance for the employed and self-employed, which came into force on 6 April, "people should start to feel the difference as well as see it in their pay cheques".

However, Rachel Reeves, Labour's shadow chancellor said working people would still feel worse off.

"Prices are still high in the shops, monthly mortgage bills are going up and inflation is still higher than the Bank of England's target," she said.

The latest inflation data comes ahead of the Bank of England's next decision on interest rates on 9 May. The UK's central bank has been increasing interest rates in a bid to slow price rises and bring inflation back to its 2% target.

The theory is that if you make borrowing more expensive, people have less money to spend, or may choose to save more as saving rates go up. This in turn reduces demand for goods and helps cool inflation.

But there are many factors the Bank's Monetary Policy Committee will take into account.

Core inflation, for example, which strips out the effect of more volatile energy and food prices, also eased to 4.2% in March.

It was still slightly higher than economists expected, and the Bank will also keep a keen eye on things like employment figures, wages and services inflation, which looks at price rises seen across hospitality to hairdressing, and stood at 6%, down from 6.1% in February.

On Tuesday, governor Andrew Bailey said the question for rate-setters at the Bank was how much more evidence was necessary before starting to cut interest rates in the coming months.

Ian Stewart, chief economist at Deloitte, said that while inflation may be in "retreat", "the Bank of England cannot yet be sure that it is beaten".

With people's wage growth remaining above forecasts, "and the economy reviving, the Bank will be in no hurry to cut interest rates", he said.

Yael Selfin, chief economist at KPMG UK, also said that Wednesday's figures were "unlikely" to move the needle for the Bank of England.

She pointed out that there are still several risks which may cause a setback.

"Oil prices have rallied over the past month which has led to an increase in prices at the pump for consumers. Also, the hike in the National Living Wage could potentially contribute to persistence in services inflation which remains elevated."

And there is still a question mark over how resilient households in the UK are, having been faced with high costs and some being left with unaffordable debts.

Next month's overall inflation figure looking back at April is expected to show a bigger drop as the lower energy price cap is taken into account, even as households' direct debits remain higher.